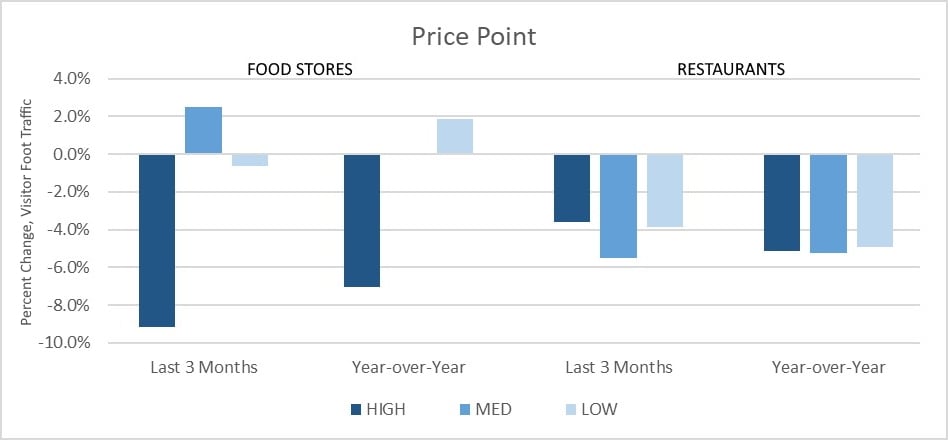

If you keep tabs on the news, you’ve heard that the economy is slowing, with some analysts suggesting that the U.S. could face a recession by the end of the year. Inflation-adjusted consumer spending slowed to 1.5 percent in the first half of 2022 (per CNBC)—compared to nearly 12 percent a year earlier. The housing market seems to finally be slowing after two years of skyrocketing home values and minimal available inventory.

Tom Kessler

Recent Posts

The 15 Fastest-Growing Metropolitan and Micropolitan Areas (4/21 to 4/22)

Topics: Data Study, Population Study, Communities Industry

Topics: Demographic Data, Data Partner, Data Quality

Topics: Market Data, Data Study, Retail Site Selection, Housing Market

The Need for Competitive Intelligence in Business Site Selection

No matter what business you’re in, understanding both supply and demand is essential. If you’re a chain business that is expanding your store base, you’re doing so under the assumption that what you have to sell is in demand. In other words, your product or service is not only appealing to consumers, but there is room for more of it in the marketplace. But what does that mean? Is there truly untapped demand and if so, how do you measure it?

Topics: Smart Retail Growth, Real Estate Analytics Tool, Market Research, Competitive Analysis

Top Metropolitan/Micropolitan Areas with Highest Out-of-Pocket Health Care Costs: 2022

Topics: Market Data, Site Selection Software, Data Quality, Health Care Industry, Analytics Solution

Topics: Demographic Data, Data Partner, Data Quality

The 15 Fastest-Growing Metropolitan and Micropolitan Areas (10/20 to 10/21)

In our last iteration of this population study, we compared two critical periods: April 2020 (the onset of COVID-19) to April 2021 (when vaccines started rolling out in the United States). The update before that, we compared October 2019 to October 2020.

Topics: Data Study, Population Study, Communities Industry

Introducing PlaceIQ to the SiteSeer platform

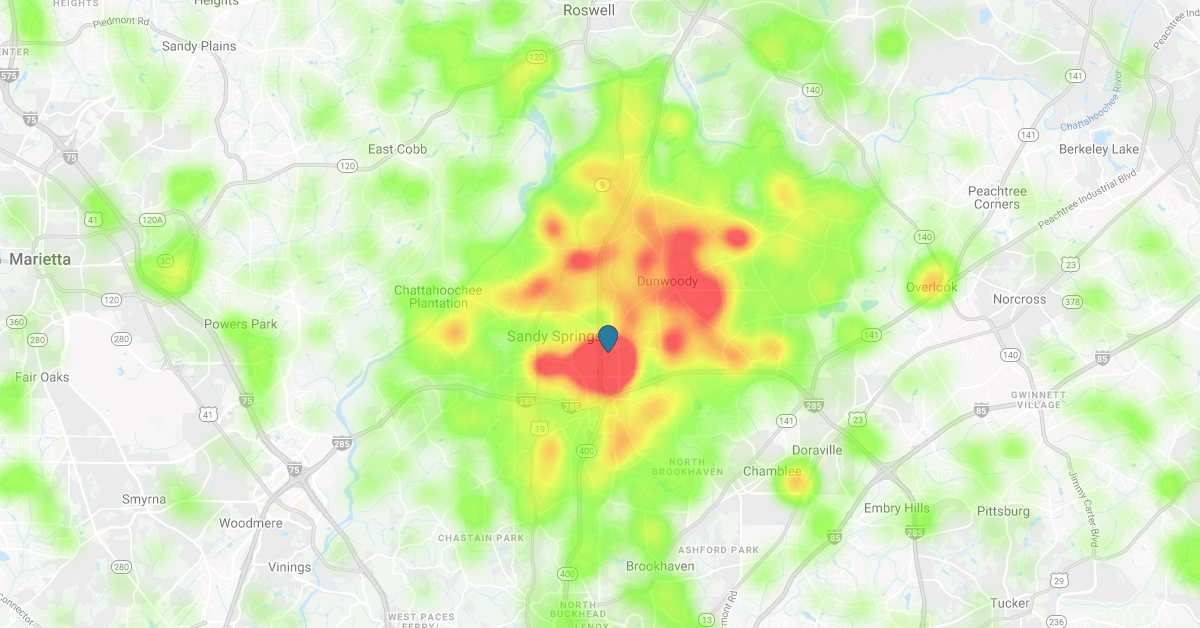

Maybe you’ve heard the news: SiteSeer has recently partnered with PlaceIQ, a pioneer in the location intelligence space. PlaceIQ’s proprietary visitation data or “foot traffic” helps companies analyze consumer movement to understand competitive trends and behaviors of the shoppers who frequent their locations.

Topics: Data Partner, Retail Site Selection, Site Selection Software, Data Quality, Cell Phone Data, Mobile Location Data

What You Need to Know About Site Selection Research

SiteSeer is in the business of site selection software, but we do a lot more than that. We help growing businesses with their market strategy, including which markets to expand into, where to find the best sites and how to forecast store performance.

Topics: Market Research, Data Study, Retail Site Selection, Data Quality